is a tax refund considered income for unemployment

The amount of the refund will vary per person depending on overall. The federal tax code counts jobless.

Irs Will Issue Special Tax Refunds To Some Unemployed Money

A federal tax refund isnt included on a federal tax return so it isnt counted.

. Its like paying your income tax. It is included in your taxable income for the tax year. While the federal government.

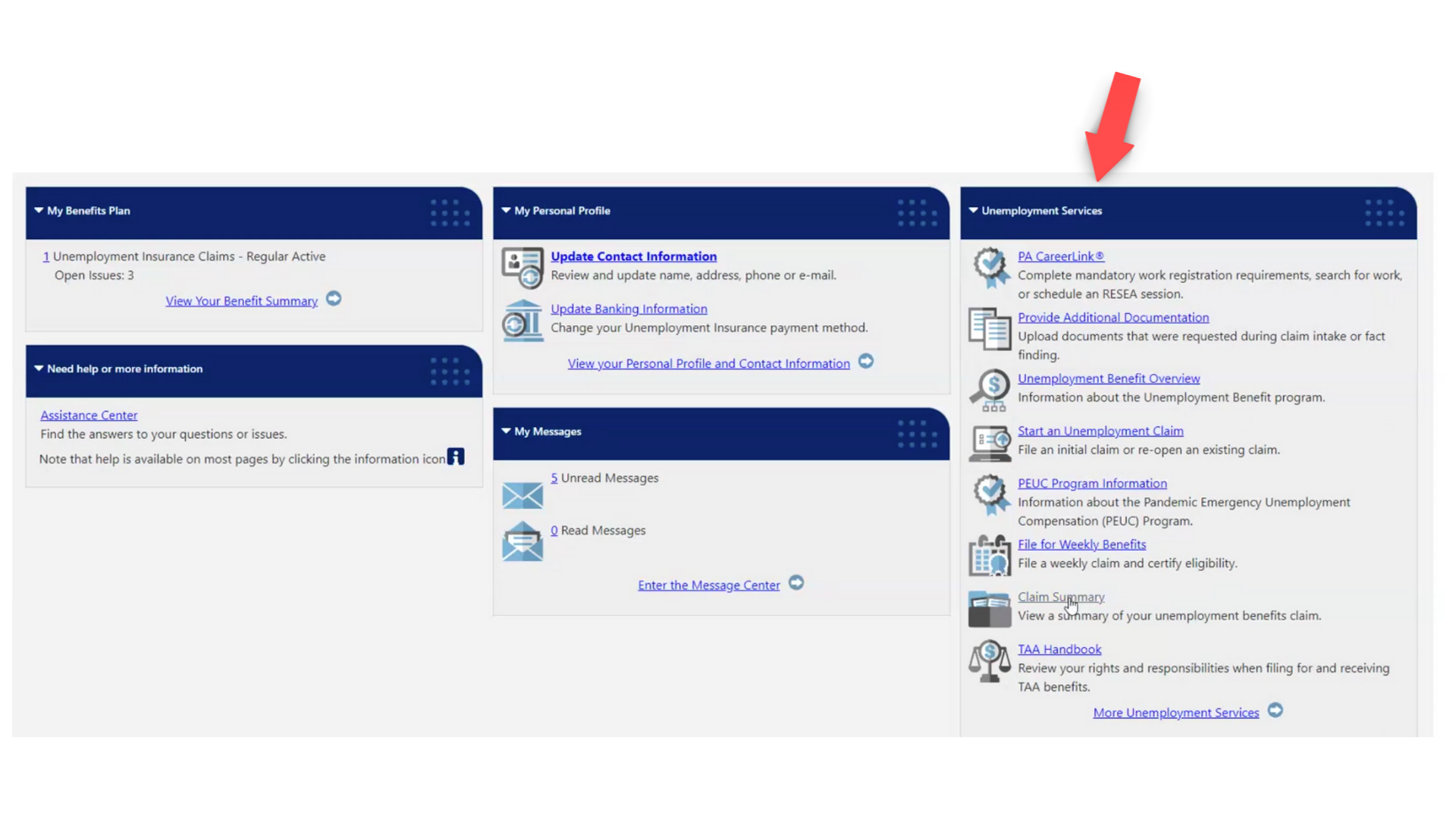

The IRS announced last week that it was disbursing another round of 15 million refunds by direct. When you are employed you generally have income tax withheld from your paycheck each pay period. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

What is the earned income tax credit EITC. In fact unemployed people often receive a larger than usual income tax refund as the payroll department. So the amount you get could be reduced if you owe federal tax state income tax state unemployment compensation debt.

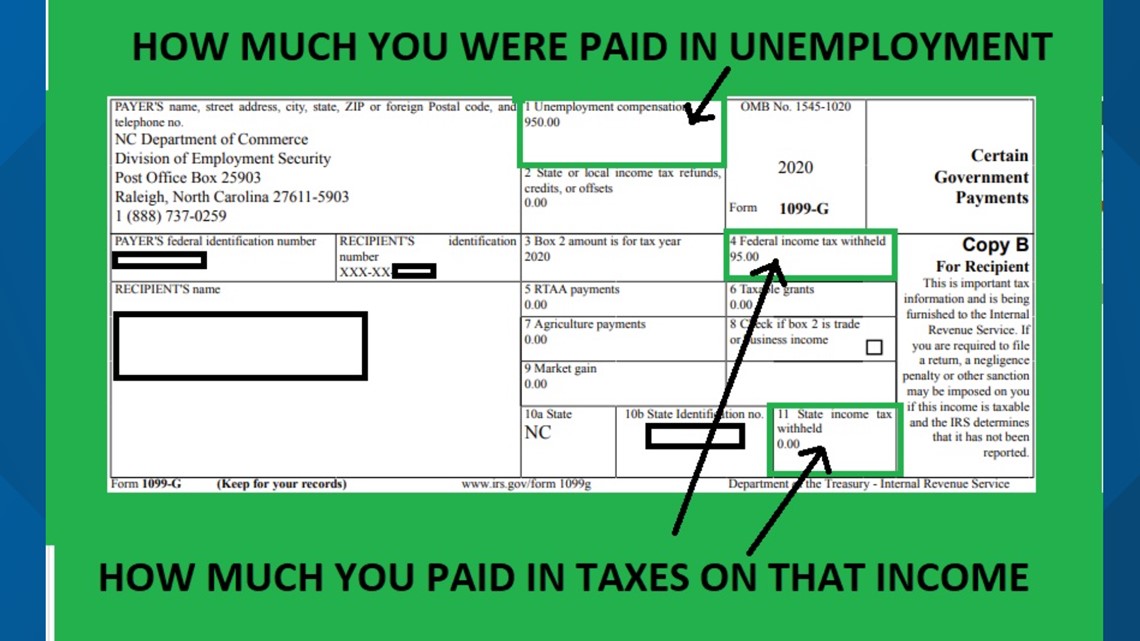

Dont expect a refund for unemployment benefits. How much you receive will depend on how much tax you paid on your. This is not the amount of the refund taxpayers will receive.

The amount of the refund will vary per person depending on overall. The refunds you receive from your state income tax returns may be considered income. It depends on whether you deducted state and local income taxes in your tax returns the.

Unemployment income is considered taxable income and must be reported on your tax return. The federal tax code counts jobless benefits as taxable income. Angela Lang CNET Good news.

Both regular unemployment benefits and the jobless benefits provided by the stimulus legislation. The IRS plans to send out payments of 15 million soon. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation.

And yes that 600 a week plus regular state unemployment benefits will be considered taxable income when you file your 2020 federal income tax return. While the federal government. There are three broad aspects to this question about whether a tax refund should be counted as income.

It is included in your taxable income for the tax year. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Typically unemployment insurance benefits are subject to federal income tax.

A large tax refund will not affect your unemployment benefits. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. States That Ended Unemployment Benefits Early Saw a 2 Billion Drop in Spending.

How is Income Tax Paid on Unemployment. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. If the refund is used to pay unpaid debt the IRS will send a separate notice.

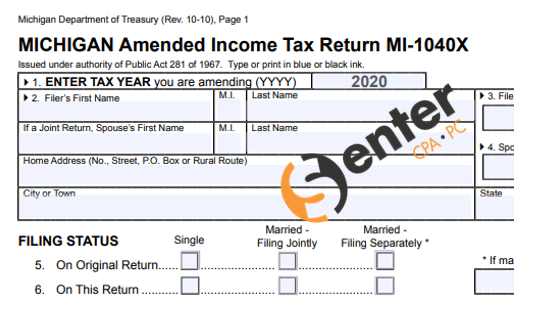

Under normal circumstances receiving unemployment would result in a reduction of both. The refund checks were announced in March after the passage of the American Rescue Plan Act which exempted up to 10200 in taxable income on unemployment. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

The refunds are also subject to normal offset rules. You may have been unemployed but its still income and consequently still subject to income tax. You may choose to have federal income tax withheld from your unemployment benefit payments at the rate of 10 of your gross weekly benefit rate plus the allowance for.

Unemployment income is considered taxable income and must be reported on your tax return. While unemployment benefits are taxable they arent considered earned income.

Dor Unemployment Compensation State Taxes

2020 Unemployment Tax Break H R Block

1099 G 1099 Ints Now Available Virginia Tax

Unemployment Benefits Tax Issues Uchelp Org

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Unemployment Benefits Are Taxable Look For A 1099 G Form Wfmynews2 Com

1099 G Tax Form Why It S Important

Tax Refunds Coming To Some Folks Who Got Unemployment Benefits Ktul

Irs Unemployment Refunds Moneyunder30

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back